Futures trading is a financial derivative of cryptocurrency, which allows investors to yield income from long buying or short selling based on their predictions of the price rise and fall. In this process, investors can also set leverage to multiply their gains.

CoinEx supports futures trading through perpetual contracts, including both the Linear Contract and the Inverse Contract. The former takes USDT as the margin and settlement currency, while the latter uses the trading coin.

The Comparison of Linear Contract (USDT-M Contract) and Inverse Contract (Coin-M Contract)

| Type | Linear ContractUSDT-M Perpetual Contract | Inverse ContractCoin-M Perpetual Contract |

| Margin | Pricing Coin(USDT) | Trading Coin(BTC, etc.) |

| Settlement Date | – | – |

| Contract Loss Mechanism | Auto-Deleveraging(ADL), Insurance Fund | Auto-Deleveraging(ADL), Insurance Fund |

| Liquidation Price | Reasonable Price Index | Reasonable Price Index |

| Price Balance Mechanism | Funding Rate | Funding Rate |

Take the Linear Contract (BTC/USDT) for an example.

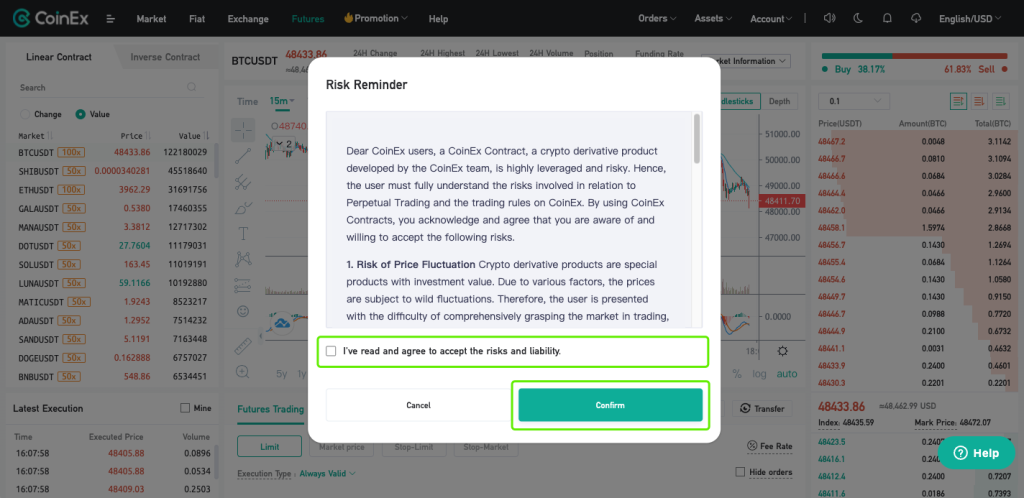

1. Log in to your CoinEx account, enter the [Futures] page at CoinEx, read [Risk Reminder], and then click [Confirm] to open a Futures account.

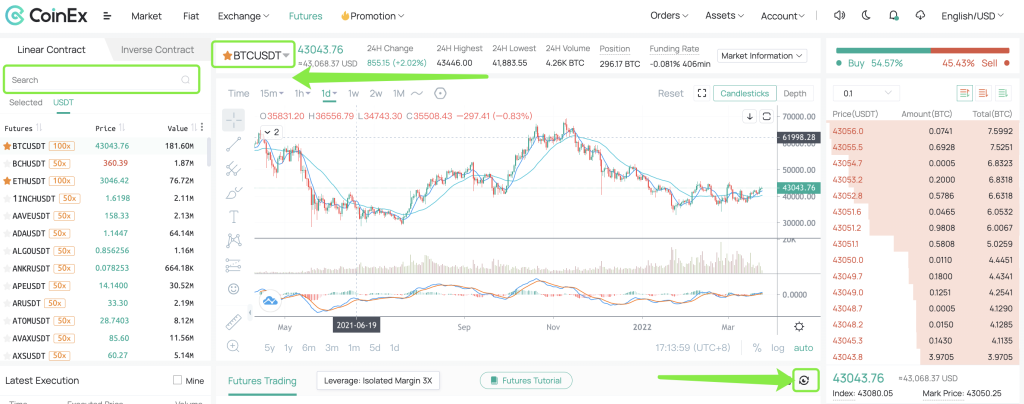

2. Select the Futures trading market and the trading pair. If there is no available asset in your Futures account, you need to transfer some first.

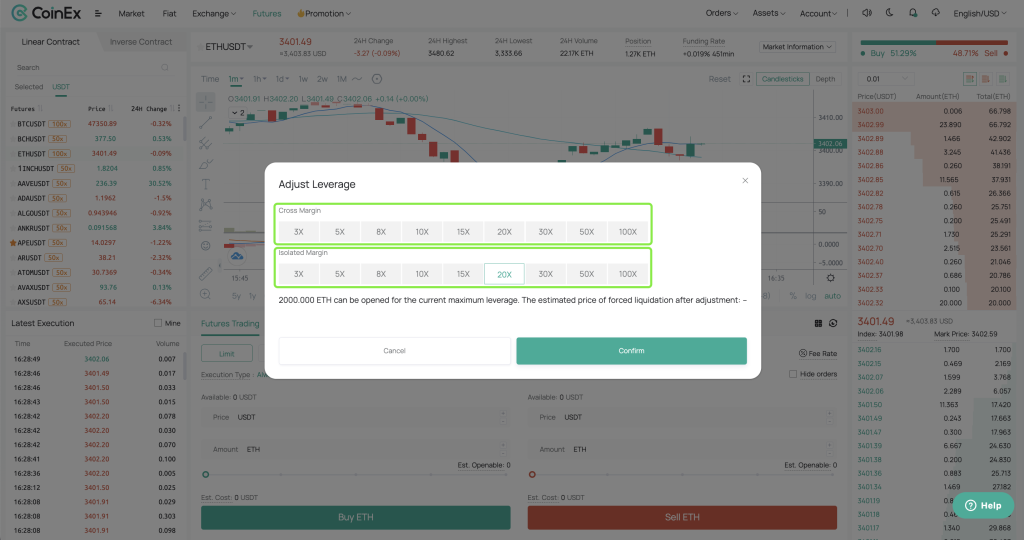

3. Set the margin mode and the leverage.

Notes:

(1) Under the Cross Margin Mode, all the available balance in the account can be used as the margin for the current position;

(2) Under the Isolated Margin Mode, only the margin of the account in the current market is used to maintain the position, and you can also increase the margin manually later;

(3) The greater leverage you set, the larger the trading amount and the higher risk it brings.

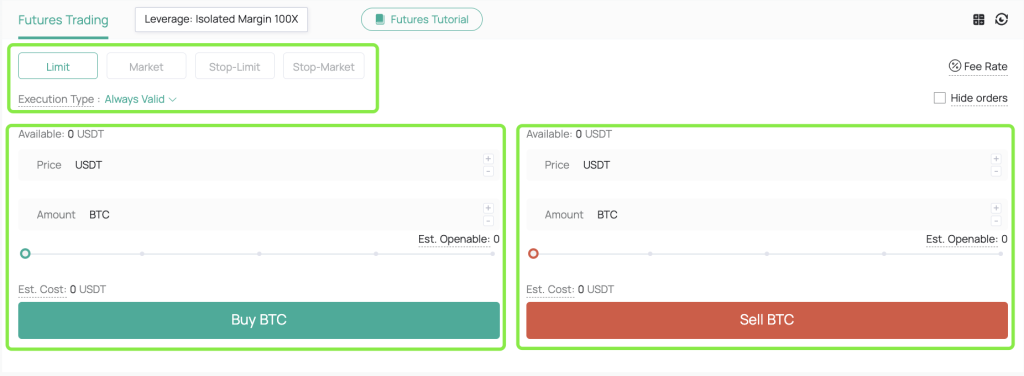

4. Select Buy or Sell, order type, set the price and amount, and then you can submit the order.

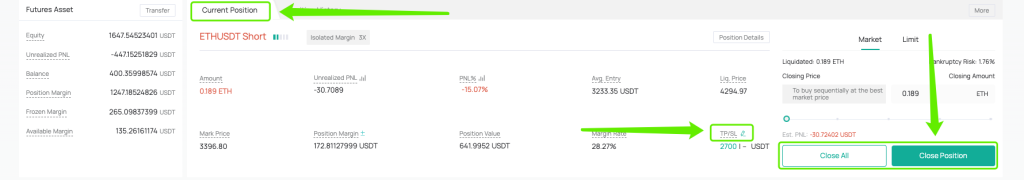

5. After placing the order, you may check the position in [Current Position], and click [Close All] or [Close Position] to close it. Or you can also use the Take-Profit & Stop-Loss feature to preset a closing price so that when the market price hits the price you set, the position will be liquidated at the market price.

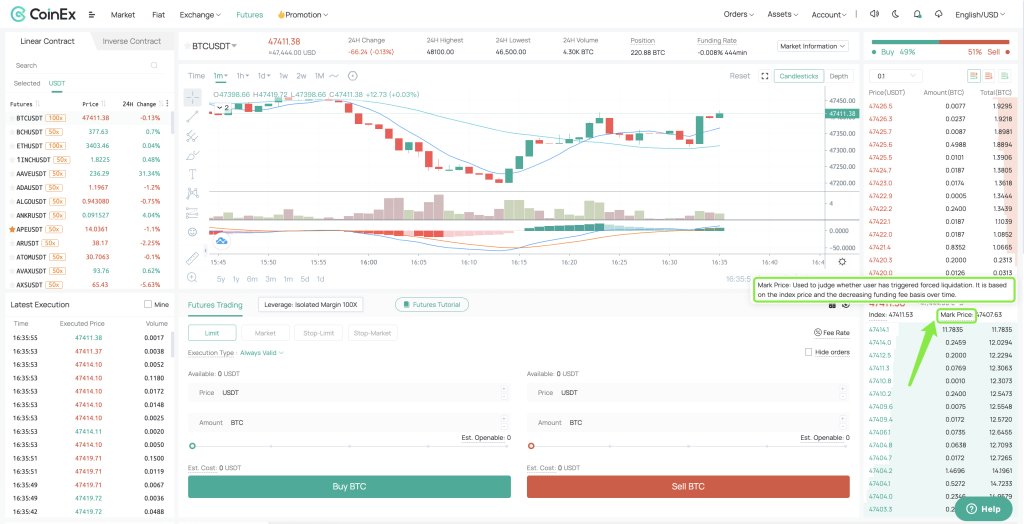

6. Please kindly be noted that CoinEx adopts the Mark Price to determine the position profit and loss and the Liquidation Price. When the Mark Price hits the Liquidation Price, a forced liquidation will be triggered. You can increase the margin in advance to reduce the liquidation risk.

Reminder: Futures trading is risky. Please control your position reasonably. For more information, please view more at our [Help Center].

Leave a Comment