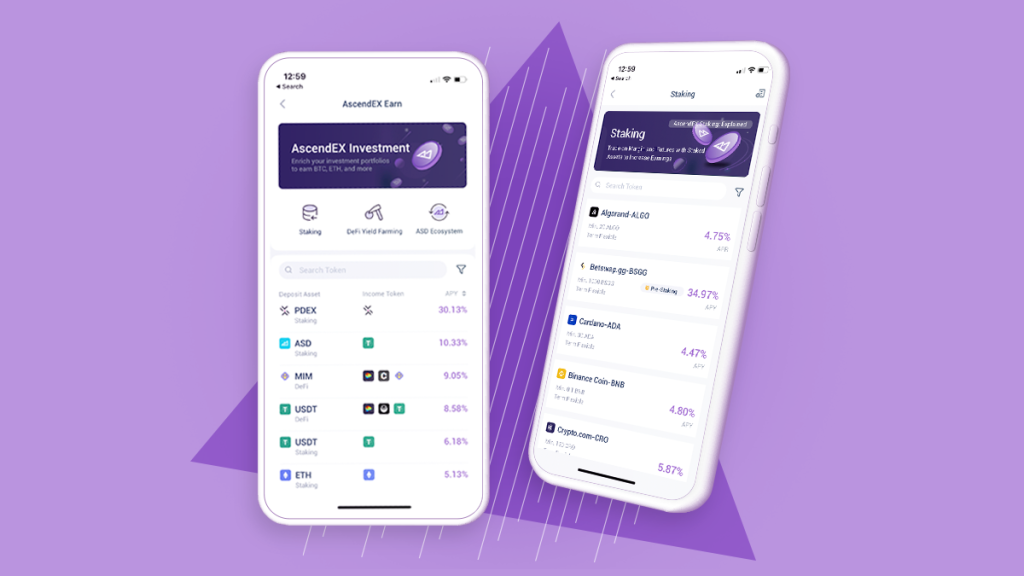

AscendEX Earn allows holders of a crypto asset to earn additional tokens (commonly referred to as “Yield”) on their token holdings, in exchange for lending their tokens to a given blockchain project or entity to utilize in the crypto ecosystem. Earn programs are not only useful to token holders, but token issuers as well. One of the primary drivers of demand for a cryptocurrency is its holder’s available options to earn additional yield on their tokens post-purchase. From an issuer’s perspective, a robust Earn program is especially useful to counteract inflation of token supply.

START USING OUR EARN PLATFORM

Most cryptocurrencies begin with a significant portion of the outstanding supply “locked”, in which case, these tokens are unavailable for market participants to freely trade on the open market. Over time, more and more of these “locked” tokens enter circulation, which like any asset, creates an excess of supply relative to demand, often resulting in price depreciation of the cryptocurrency, and a subsequent reduction of wealth for all holders of the token. Earning yield on your tokens via AscendEX Earn is a prudent option to avoid a reduction in the value of your crypto holdings as this process plays out over time. The next section will focus on different types of earn programs offered by AscendEX, a brief overview of each, as well as how a token holder may participate.

?What Types of Earn Programs Does AscendEX Offer

AscendEX offers platform users six different kinds of earn programs; Staking, DeFi Yield Farming, Liquidity Mining, Lending & Borrowing, Project promotional, and AscendEX Promotional.

Staking

Before exploring the broad utility and various types of staking programs, it is useful to first define a few concepts which underlie the process of staking.

A “Proof of Stake” (PoS for short) blockchain functions via a distributed network of “validators”, which each retain a copy of the blockchain’s transaction history and are randomly selected (based on a pre-set algorithm) to approve new transactions, which if truthful, are added to the existing transaction history. This type of staking is commonly referred to as Native Ecosystem Staking.

In order to participate in Native Ecosystem Staking, holders of the native token must “stake” a portion of their token holdings, which is a process that locks up the holder’s tokens for the duration of their stake. These “staked” tokens are unavailable for the holder to freely exchange for the entirety of this process until the staker decides to “unstake” and reclaim their tokens. In exchange for their services, the staker is rewarded with new tokens each time they successfully validate a truthful transaction and add it to the existing transaction history. Examples of popular blockchain projects which deploy their own blockchain are Ethereum,Cosmos, and Solana.

In this case, the primary benefit to the blockchain project in the deployment of their staking program is to encourage active participation in the network on behalf of token holders. The staking rewards paid to validators represent the cost incurred to incentive this participation. Without offering these rewards, ecosystem members would have no incentive to invest their time and energy in upholding the network, and the network would cease to function.

At the inception of the blockchain’s creation, the developer team will allocate a preset amount of the token’s supply to fund staking rewards to willing validators. In addition to this, they will pre-set the rate (or APR) at which the staker may earn new tokens as payment for their services.

Lastly, it is important to mention that participation in native ecosystem staking often comes with high barriers to entry, such as the minimum amount of tokens a staker must have available to lock up and participate, as well as access to the hardware necessary to conduct this process. For this reason, AscendEX runs validators on 50+ separate blockchains and offers its users the ability to delegate smaller portions of tokens to earn staking rewards. In this Staking as a Service model, AscendEX handles all the validation work on behalf of the user, democratizing participation in staking for all platform users.

Liquidity Mining

Liquidity mining is an activity pioneered by DeFi protocols Compound and Uniswap during the “Defi Summer” of 2020. These protocols represent decentralized exchanges and credit markets in which external users must be economically incentivized to willingly provide their token holdings as usable liquidity for other users to exchange, borrow, or lend. Before liquidity mining, decentralized protocols would simply offer liquidity providers a cut of transaction fees accrued by the protocol. Compound and Uniswap took this process one step further, offering liquidity providers rewards denominated in the native protocol token, on top of their normal cut of trading fees.

To provide an example, say a user deposits ETH and USDC holdings to a Uniswap liquidity pool for other Uniswap users to exchange ETH for USDC or USDC for ETH. The former user would earn a cut of trading fees in both ETH and USDC, as well as an additional share of rewards in UNI, Uniswap’s native protocol token.

Like staking, liquidity mining often comes with high barriers to entry in the form of gas fees, which are transaction fees incurred by liquidity providers each time they attempt to make a transaction on the protocol. Gas fees are charged by validators in exchange for their work processing and validating transactions on the blockchain. AscendEX eliminates these barriers for their platform users by covering all gas fees on behalf of the user, as well as handling all deposits to and from the protocol. AscendEX users may take part in liquidity mining across a handful of popular DeFi protocols all from one seamless dashboard, while never paying a penny in gas fees.

DeFi Yield Farming

DeFi Yield farming is a broader set of activities that includes Liquidity Mining as well as other Yield Farming Strategies such as Native Protocol staking or Yield Optimization Vaults. Below is a brief overview of each of these activities.

Native Ecosystem Staking

As discussed, the most common types of protocols in today’s crypto economy are decentralized exchanges (where users may freely exchange different tokens) and lending/borrowing markets (where users may participate in a permissionless credit market for cryptocurrency loans). In both cases, these protocols will additionally offer native protocol staking as a means to take the process of liquidity mining one step further, as users may then lock up the reward tokens they have just earned from liquidity mining to further increase their total yield (hence the term yield farming). In the same manner, as projects which deploy blockchains, protocol teams will allocate a pre-set amount of the token’s supply to fund staking rewards to willing stakers, as well as the rate at which stakers may earn rewards.

Vault Strategies

“Yield Optimization Vaults” are DeFi protocols that allow users to put their yield farming on autopilot, in the same manner as a “robo-advisor”, via the automatic delegation of deposited tokens to/from various other protocols which offer market-leading yields. Protocols such as 1inch or Beefy Finance are popular examples of Yield Optimization Vaults. Oftentimes, these Yield Vault protocols additionally deploy their own native token, which user rewards are denominated in, and users may additionally stake within the protocol to further increase their yield. This strategy differs from Native Ecosystem Staking in the sense that protocols do not maintain networks of validators in order to uphold a network, given the protocol is deployed on an already functioning blockchain. This is important in how the incentives of staking-participation differ on the part of both the protocol team as well as the token holder.

Centralized Lending

Centralized lending is a type of Earn product in which AscendEX users are offered the ability to lend their tokens to a centralized lending/borrowing business, or a centralized market maker. This concept is like allocating your money to a hedge fund, in which their primary goal is to run successful trading strategies which generate yield on borrowed capital. The hedge fund then pays interest to their creditors in exchange for the ability to utilize their funds in their trading strategies. AsendEX maintains relationships with a handful of these counterparts and facilitates lending to these parties on behalf of platform users. The interest rate earned is dependent on what these parties are willing to pay in interest on capital borrowed from willing lenders. Like the aforementioned Earn products, AscendEX handles all transactions to and from these counter parts, while the user may sit back and earn rewards until they wish to retain the lended funds.

Project Promotional

Project Promotional Earn products are products in which a blockchain project allocates a given portion of its outstanding supply to pay staking rewards to users who are willing to lock up their token holdings and participate in staking. These earn programs are popular for blockchain teams whether or not they have launched their own native blockchain technology or rather have built a protocol to exist on an external blockchain. In the former case, the project may have chosen to release its token for trading before its staking mechanism is launched for active participation from token holders, in which case they will fund “staking” rewards out of pocket until the native ecosystem staking mechanism is ready for use. At which time, they will transition payment of user rewards from directly out of pocket to automatic payment to validators, in accordance with the pre-set staking reward rate encoded in the blockchain’s code.

In the latter case, a project team without a proof-of-stake blockchain may wish to launch a project promotional earn product to promote awareness and drive demand for their native token. By providing token holders the option to lock up their tokens for the ability to earn rewards, they hope this will result in an increased demand for the token relative to the existing supply, resulting in the positive price appreciation of the native token. Project Promotional Earn products represent a fairly low risk earning opportunity to token holders, given the reward rate is pre-set in advance by the project team and fixed from that point forward. Though participants must ensure themselves that the token, and hence, their rewards, will maintain their market value, they are not nearly as susceptible to fluctuations in the rate of rewards, as is the case with DeFi-related Earn products which derive their yield from open-market supply and demand conditions.

AscendEX Promotional

AscendEX promotional Earn products are extremely similar to project promotional products, with the primary difference being that rewards are funded by AscendEX, rather than the project team behind the given token. Amongst other reasons, AscendEX may choose to launch these types of earn products to drive awareness of the ability to trade/earn a given asset on the AscendEX platform. This is beneficial to users because AscendEX may launch Earn products of this nature on a plethora of different cryptocurrencies and does not need the commitment to fund rewards from external parties, along with the aforementioned perks of low-risk & fixed rates of return.

?What Cryptocurrencies can I stake on AscendEX

AscendEX’s platform-native staking products remove all technical barriers to entry and allow users of all levels to participate and earn rewards directly on the platform with an intuitive user experience. We have over 70+ assets that can be staked on our platform today. Here is a short list of assets on our platform.

- Stake Ethereum

- Stake Bitcoin

- Stake Tether

- Stake Akash

- Stake Cosmos

- Stake Sushiswap

- Stake Polygon

- Stake Solana

- Stake Tezos

- Stake Avalanche

- Stake Ecomi

- Stake Fantom

- Stake Aave

Conclusion

In sum, Earn products offer holders of a given token the ability to earn additional tokens (in the form of rewards) in exchange for the delegation of their crypto holdings to DeFi protocols, blockchain project teams, centralized trading counterparts, and other ecosystem participants. For prospective token holders, the availability of earn programs for the given token is an important factor to consider in the evaluation of different cryptocurrencies one may purchase. For token issuers, Earn programs may help mitigate the negative effects of token inflation. To learn more about the full suite of Earn products on the AscendEX platform, see here.

Frequently Asked Questions

?Are there any additional fees associated with the service

There are no additional fees for staking with AscendEX. The estimated annualized reward posted on the Website is an estimate of the net staking rewards that users are expected to receive, though the actual rewards may vary slightly due to network condition changes for each project.

?Is there any minimum staking time or lock-up period required for staking

Unlike some other staking service providers, AscendEX does not require minimum staking time, nor any predetermined lock-up period for participation.

Leave a Comment